By Malick Nyang

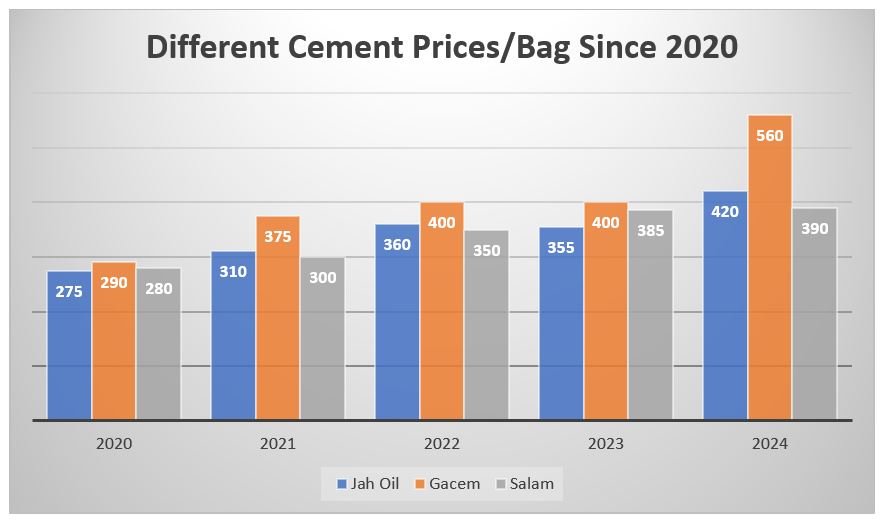

The Gambia has no cement manufacturing company as it doesn’t have the raw materials to produce cement. All cement consumed in the country is imported either in powdered form for packaging in local brand or in bagged foreign brand.

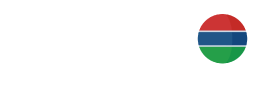

The Small and Medium Enterprises (SMEs) import in bags while the re-bagging companies import in powdered form. There are currently three re-bagging companies in The Gambia: Gacem, Salam and Jah Oil.

Over the last few years, there has been intense competition between the re-bagging companies and the importers of bagged cement. This competition has led to consumers benefiting from wide range of choices, good quality of cement at competitive prices.

The imported bagged cement is concentrated up country while the Greater Banjul Area (GBA) is supplied mainly by the three re-bagging factories: Salam, Gacem and Jah Oil Company.

A standoff ensued recently when it was announced that the Gambia Government increased the tax on importation of cement into the country. It was revealed that instead of the thirty (30) dalasi per bag, importers were now to pay up to hundred and eighty dalasi per bag in order to get cement into the country.

As a result of this, a number of trucks loaded with cement from Senegal got stranded at the border as they failed to pay the amount. The officials also refused to let them in if they do not pay the right tax. Thus, began a back and forth between the association of importers and repackaging factories.

The data shows the rise of cement prices since 2020 from retail businesses. The price of cement is never fixed; it varies yearly and in different locations. A bag of cement cost D280 in 2020.

In 2021, a bag cost D300, D325, D350 and even D400 at some locations within the Greater Banjul Area, due to shortage of cement within a short period of time. This was sustained until 2024 when The Gambia faced another cement crisis due to a sudden increment of cement tariff by the government. With government’s declaration of new tariff in 2024 for both wholesale and retail prices, real-life encounters and challenges faced by consumers on the pricing remain unchanged, similar to 2021.

IMPACT OF TARIFF INCREMENT ON CEMENT PRICE IN 2019

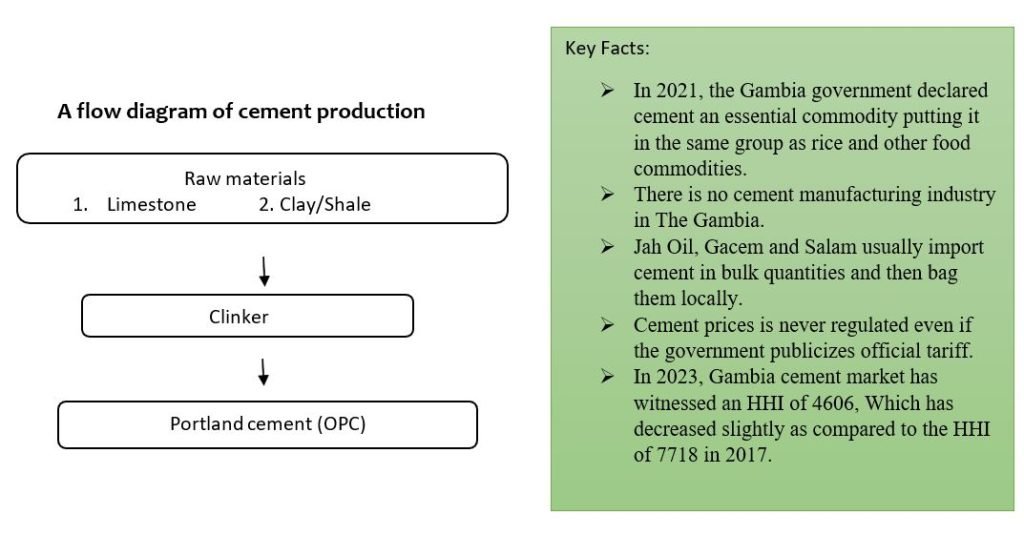

The chart above shows that all regions visited pay more for a bag of cement after the tariff increment than the pre-tariff. The tariff increment has led to a price increased in the price of imported bagged cement above competitive price most especially in the provinces.

Central River Region (CRR) and North Bank Region (NBR) suffered the most as consumers in these regions pay D77 and D76 more per bag respectively than the competitive market price. The average price of a bag of cement was D230 and D232 in Central River Region (CRR) and NBR respectively before the tariff increment compared to D307 and D308 post tariff.

The chart depicts that the price of cement was between D230 and D265 in the country with the provinces enjoying the lowest price. It is interesting to note that the tariff increment has seen the provinces paying more for bag cement than the GBA. The price of cement in the CRR before the tariff increment was as low as D230 but increased to an average of D307per bag after the tariff increment. This implies that the policy is regressive as the poorest region bears most of the cost of the policy.

This new tariff protection for re-bagging companies has brought some of the businesses of the importers of bagged cement to a standstill especially in the provinces. The affected businesses complained that paying the new tariff will make it impossible for them to sell their cement profitably (affordable) in the Gambian Market.

Dr. Ousman Gajigo, the Manager of the Microeconomic, Institutional, and Development Impact Division in the Research Department of the African Development Bank, wrote that cement is arguably the most important input in infrastructure, whether it is for housing or road construction.

“The government should be striving towards lowering the cost of cement so that ordinary Gambians building houses would find it more affordable,” Gajigo wrote in an article: Understanding the Cement Crisis.

“Similarly, lower cement price is useful for the government because it will lower the cost of building schools, hospitals and roads, among others. Put differently, reducing the cost of an important input such as cement should be among the highest priorities of the government because the gains from reducing the infrastructural deficit would more than compensate for any short-term loss in tax revenues.”

Sources:

https://www.6wresearch.com/industry-report/gambia-cement-market

https://gcc.gm/wp-content/uploads/2023/02/Cement-tariff-impact-assessment-2019.pdf

https://foroyaa.net/gambia-government-regulates-prices-of-cement/

https://gcc.gm/wp-content/uploads/2018/05/CEMENT-MARKET-STUDY.pdf