By Yusef Taylor, @FlexDan_YT

In 2023, President Adama Barrow said that “audit reports are opinions” and that “auditors can make mistakes or be biased.”

Investigative outlet, Malagen, translated what Barrow said in Wolof as follows:

“You know most of these allegations of corruption in my government are emerging from audit reports. And audit reports emerge from opinions. It is not conclusive for us to make decisions. Audit reports can have mistakes and can be biassed. If a claim is made, we must make our internal investigations… We cannot use opinions to give people a death sentence. We must first establish the case first based on the claims made.” Listen from 54:00 minutes in video below:

More recently, during an interview on West Coast Radio’s Coffee Time with Peter Gomez, the Minister for Information, Media and Broadcasting Services, Dr. Ismaila Ceesay reiterated this notion, stating that audit reports are “opinions” and that “auditors just look for paper trail.”

Claim: Dr. Ismaila Ceesay: “For me, audit reports, like I said, and that’s what audit reports are, [it] doesn’t mean that a crime has happened.”

Peter Gomez: “Yeah, we know they are just opinions.”

Dr. Ceesay: “Yeah, they are opinions and based on, for example, if you come to audit me today, for example… Auditors just look for paper trail; that’s what they look for. And they see that D400 was spent, but there is no paper to show that it was spent; they’ll flag it.”

Peter Gomez: “And rightly so.”

Watch the exchange in the link below from the 26-minute mark.

Therefore, information, this factsheet seeks to explain audit processes and

Audit reports usually contain a methodology section that explains how they are conducted. The most recently published audit report by the National Audit Office (NAO) highlights that its audit is conducted “in accordance with the International Standards of Supreme Audit Institutions (ISSAIs) issued by the International Organisation of Supreme Audit Institutions (INTOSAI).”

Auditors don’t set the accounting and financial rules that government institutions are legally bound to follow. These accounting and financial rules are policies approved by the Cabinet and, in other instances, passed through acts of the National Assembly, such as the Public Finance Act.

It’s important to note that the budget, which is passed by an Act of Parliament, is also a law that auditors use to ensure that funds allocated in the budget are spent appropriately. In their totality, these accounting rules dictate how funds are utilised and accounts are to be kept. This is why all government institutions employ the services of accountants and finance officials to maintain their books accordingly.

-

Accuracy of financial statements: One of the primary objectives of an audit is to ensure the accuracy of financial statements. Auditors review financial statements to check that the numbers are correct and have been calculated using appropriate accounting principles. They also check that the financial statements comply with relevant regulations and standards.

-

Internal controls: Auditors also review internal controls in place to ensure the accuracy of financial statements. Internal controls refer to the processes, policies, and procedures a company has in place to safeguard its assets and ensure the accuracy of its financial statements. Auditors will test the effectiveness of internal controls to determine if they are sufficient to mitigate risks.

-

Fraud prevention: Another important aspect of an audit is fraud prevention. Auditors are trained to identify potential fraud risks and to investigate any evidence of fraudulent activities. This is critical in ensuring that financial statements are accurate and reliable.

-

Completeness of financial statements: Auditors also look for the completeness of financial statements. They check that all financial transactions have been recorded and that there are no missing transactions. Auditors also review supporting documentation to ensure that all financial transactions are properly supported.

-

Materiality: Materiality refers to the significance of an item or transaction in the financial statements. Auditors will evaluate materiality to determine whether an error or omission in the financial statements is significant enough to affect the overall accuracy of the statements. This evaluation is based on factors such as the size of the item, the nature of the item, and the risk associated with the item.

-

Compliance with regulations: Finally, auditors look for compliance with relevant regulations. They ensure that financial statements comply with accounting standards, tax laws, and other regulations. Auditors will also review the company’s adherence to its own policies and procedures, such as its code of ethics or corporate governance guidelines.

REPORTING AUDIT FINDINGS

In The Gambia’s case, audits are conducted using standard guidelines from the ISSAI.“The [audit] opinion can be unqualified, qualified, adverse or disclaimer based on how the audit findings overall materially affect the financial statements,” an audit expert told FactCheck Gambia.

While audit reports reflect the opinions of the auditor(s), “… they are the result of diligent performance, in good faith and with integrity, the gathering and objective evaluation of [the] evidence [gathered during an audit]”, according to Gambia’s former Auditor General, Karamba Touray.

Here are the four (4) types of opinions you may find in an audit report as gathered from AFROSAI-E and Activity Covered, an online resource for businesses.

1. Unqualified Opinion: An unqualified opinion indicates that the auditors have found no material misstatements in the financial statements and that the statements are fairly presented in accordance with applicable accounting standards.

2. Qualified Opinion: A qualified opinion is issued when the auditors have found a material misstatement that is not pervasive to the financial statements. The report will specify the nature of the misstatement and its impact on the financial statements.

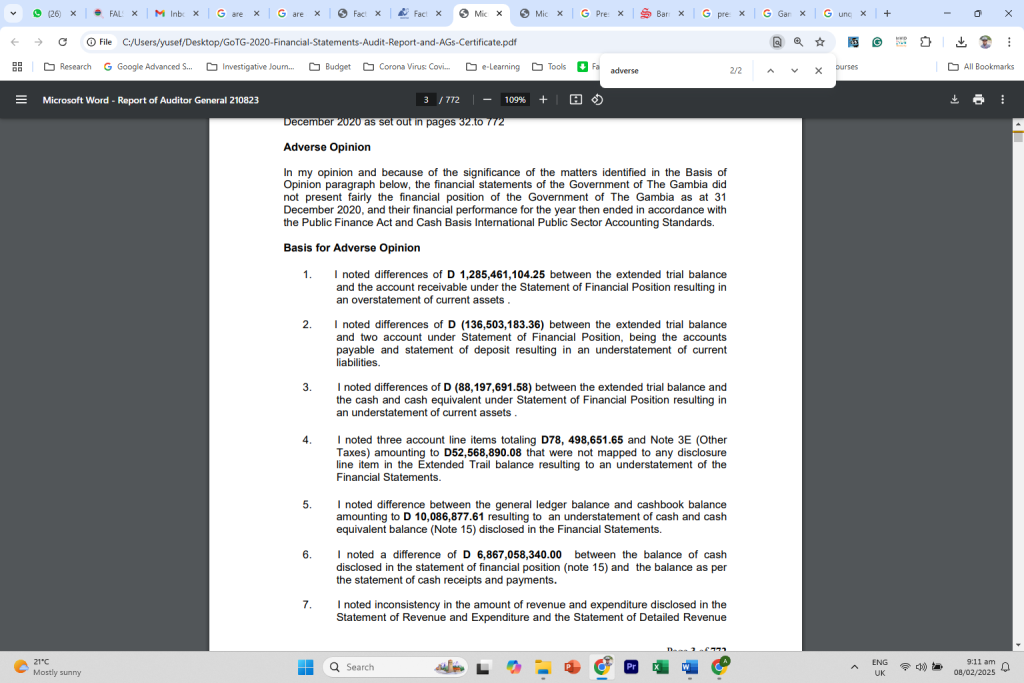

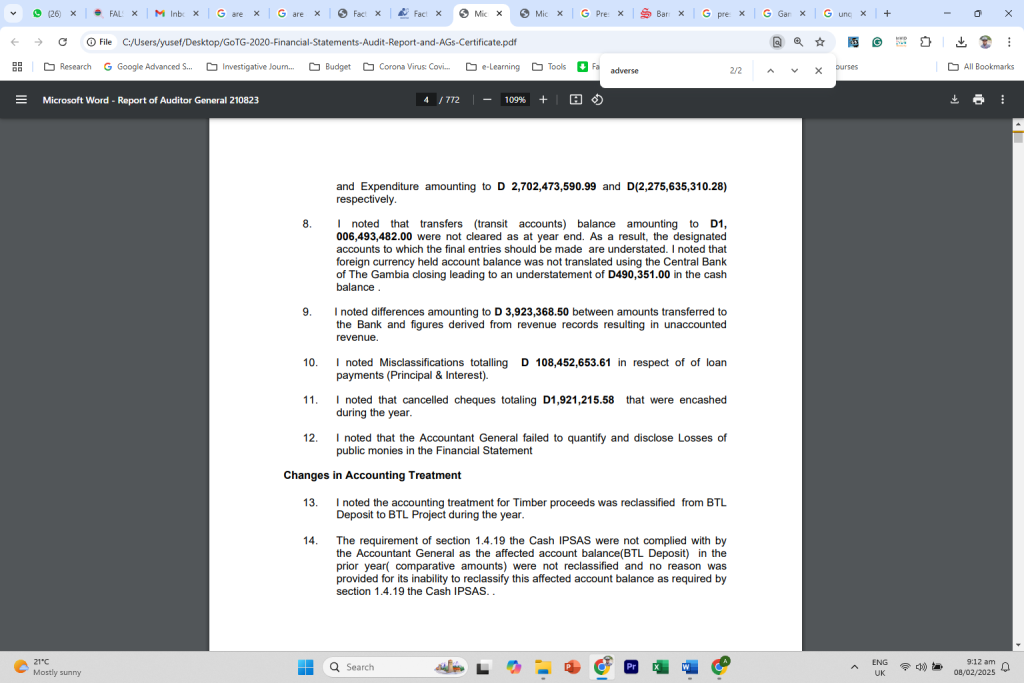

3. Adverse Opinion: An adverse opinion is issued when the auditors have found a material misstatement that is pervasive to the financial statements. The report will clearly state that the financial statements are not fairly presented.

4. Disclaimer of Opinion: A disclaimer of opinion is issued when the auditors are unable to form an opinion on the fairness of the financial statements due to a lack of sufficient evidence or significant limitations on the scope of the audit.

On Dr. Ceesay’s claim that auditors just follow a paper trail and make their conclusions, it’s important to note that after auditors gather all their evidence to ascertain if the accounting and finance laws have been followed, these findings are shared with the relevant institutions in a “Management Letter,” and an agreed timeframe is set for institutions to send “Management Responses” to the findings.

“Management Letters” identify all the findings in the audit report and provide the management of the relevant institutions with an opportunity to respond. The responses to every finding are included in the audit report, making the work of auditors more than just a paper trail. When required, auditors hold meetings, interrogate stakeholders, and verify documents submitted.

The NAO’s 2020 Audit Report is a 772 pages is accompanied by a 359-page Management Letter. It also provided an “Adverse Opinion” on the Government of The Gambia’s Financial Report. See example below: